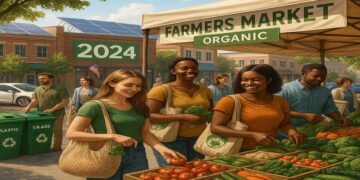

Trends in Green Consumption and Its Impact on the American Economy in 2024

The rise of green consumption in 2024 reflects a transformative shift in American buying habits, prioritizing sustainability and local products. Innovations in fintech, sustainable fashion, and green tech foster economic resilience while promoting eco-friendly practices. This trend enhances consumer choices and contributes to a sustainable future for the economy.

The role of financial support networks for social entrepreneurs

Financial support networks are vital for empowering social entrepreneurs by providing access to funding, mentorship, and collaborative opportunities. These networks enhance social impact through innovative financing solutions, including crowdfunding and decentralized finance, while fostering relationships with investors. As technology evolves, these networks promise a transformative future for social innovation.

Financial challenges faced by entrepreneurs during economic crises

Amid economic crises, entrepreneurs face significant financial challenges, including cash flow management, access to capital, and market volatility. However, innovative technologies like fintech solutions and blockchain provide opportunities for resilience. By embracing these advancements, business owners can adapt their strategies to navigate uncertainties and secure sustainable growth.

Crowdfunding: How to Use Crowdfunding Platforms to Boost Businesses

Explore how crowdfunding is transforming the financial landscape for entrepreneurs. Learn to leverage crowdfunding platforms effectively, engage communities, and utilize emerging technologies like AI and blockchain to succeed in securing funding. Discover the importance of market validation and building supportive networks for thriving business growth.

The impact of interest rates on the financial decision-making of entrepreneurs

In a volatile financial landscape, entrepreneurs must navigate the impact of fluctuating interest rates on decision-making. Understanding how these rates influence investment timing, borrowing costs, and consumer behavior is crucial. Embracing technology and enhancing financial literacy can empower business owners to adapt and thrive amidst changing economic conditions.

How Data Analysis Can Optimize Financial Management in Small Businesses

Data analysis is revolutionizing financial management for small businesses by enhancing budgeting, cash flow management, and investment strategies. With advanced technologies like AI, real-time reporting, and cloud platforms, small business owners can make informed decisions, optimize resources, and drive growth in a competitive marketplace.

The importance of financial education for beginner entrepreneurs

Financial education is essential for beginner entrepreneurs navigating today's dynamic business landscape. Understanding financial principles empowers informed decision-making, enhances funding access, and fosters innovation. By embracing emerging digital tools and community resources, novice entrepreneurs can sustainably grow their businesses while adapting to the ever-evolving financial environment.

Impact of Technology on Financial Management Practices for Small Businesses

The article explores how technology is revolutionizing financial management practices for small businesses. Key innovations like automation, cloud computing, and data analytics enhance efficiency, accuracy, and strategic decision-making. As these tools proliferate, small businesses can better navigate financial complexities, ensuring growth and competitiveness in an evolving marketplace.